Payment schedule

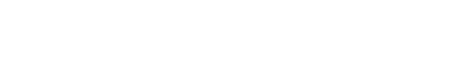

Payment schedule – 21 days in PLN

“Payment schedule – 21 days in PLN” – the chart presents a forecast of financial flows for the next 21 days. It allows users to assess how the company’s payment schedule is shaping up and on which days a cash surplus or shortage may occur.

The chart displays:

-

Receivables (red) – amounts expected from contractors in the coming days,

-

Liabilities (green) – amounts the company should settle in the following days,

-

Balance (blue) – the difference between receivables and liabilities on a given day.

Thanks to this chart, the user can quickly assess which days will bring the highest payment burdens and when inflows are expected, enabling more effective financial liquidity planning.

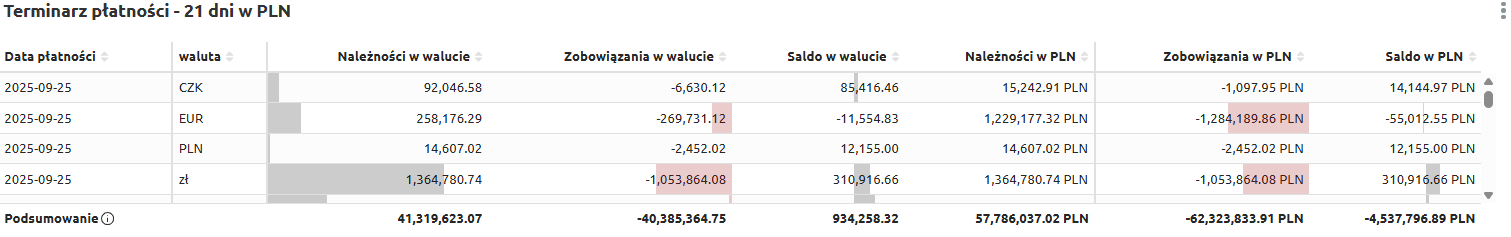

Payment schedule – 21 days in PLN – table

“Payment schedule – 21 days in PLN – table” – this summary presents a forecast of receivables and liabilities for the next 21 days, broken down by currencies.

The table includes the following fields:

-

Payment date – the day on which the payment is scheduled,

-

Currency – the settlement currency of the payment,

-

Receivables in currency – expected inflows,

-

Liabilities in currency – planned outflows,

-

Balance in currency – the difference between receivables and liabilities,

-

Receivables in PLN – receivable values converted into PLN,

-

Liabilities in PLN – liability values converted into PLN,

-

Balance in PLN – the final difference between receivables and liabilities in PLN.

The table uses color highlighting:

-

Red – the more intense the color, the lower the value (below 0),

-

Gray – the more intense the color, the higher the value (above 0).

Thanks to this, the table allows users to check on which days and in which currencies financial surpluses or deficits may occur, as well as to analyze the balance after conversion to PLN.

The table includes a search field, allowing data to be narrowed to selected dates or currencies. In such cases, summaries automatically adjust to the filtered results.

Additionally, data can be sorted by clicking column headers – for example, to arrange payments by date, currency, or balance value.